Future DAO Returns

For the purpose of complying with U.S. securities laws, the future financial returns of the DAO will be distributed in two different manners. For those that invested directly into the LLC through the fund will receive their funds in the standard manner of a VC fund. For those that invested through the DAO (Limited Cooperate Association, or LCA) with its membership tiers the process is a bit different.

DAO Member Returns

The DAO will redistribute the returns for its members based on two major factors. First, based on the membership tier they bought into and second, the amount of patronage tokens you currently own. Here is an example.

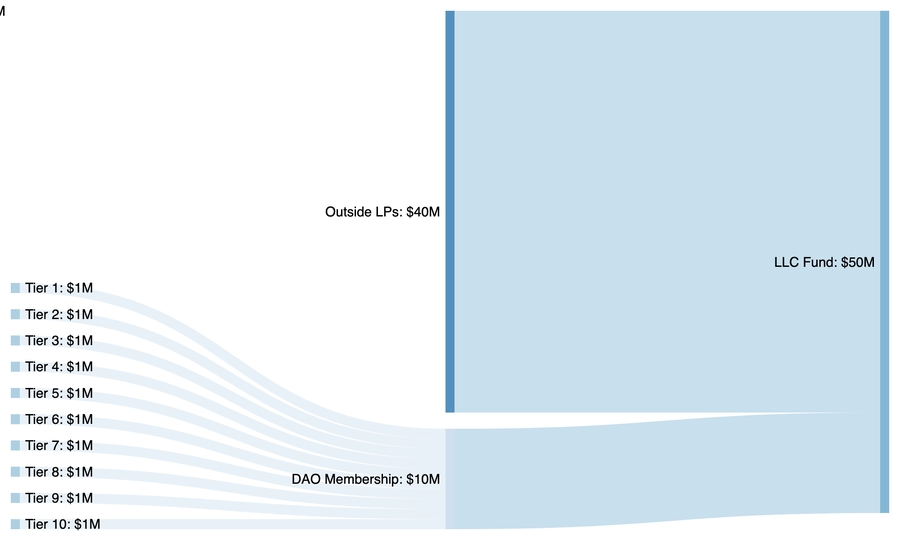

In this example we'll say we have ten membership tiers ranging from $10 to $100k. If we assume that each of these ten tiers raises $1M the DAO would then contribute a total $10M to the LLC fund as outlined in the previous section. The future patronage dividends to the DAO would then be based off their returns as LPs as well as their returns from their management carry. A certain allotment of that return would be earmarked for the individual membership tiers and another allotment would be earmarked for patronage token holders. Here is an example from start to finish.

First, on the fund, we'll assume (For the sake of example and using round numbers) we raise $40M from various LPs. On the DAO side we'll assume that our ten separate membership tiers raise $1M each (though SG DAO has fewer membership tiers than the example below). That money is then invested into the fund as an LP, totalling our pooled capital to $50M. The DAO, more specifically the full-time employees of the DAO, will receive a 2% management fee per year over the lifetime of the fund (here we assume $1M a year for 5 years) to cover legal, operational, and platform expenses.

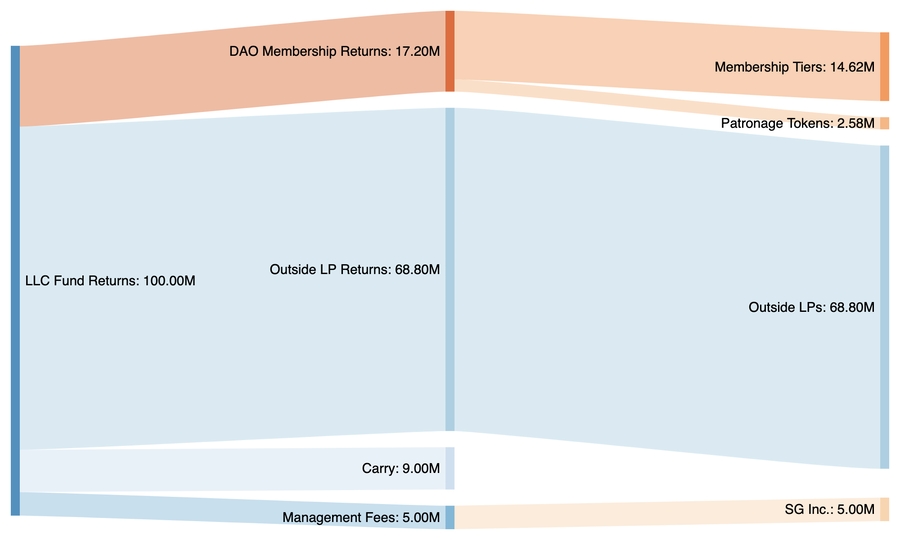

If we assume, after a few years the fund is able to return $100M. That money goes to four separate locations. $68.8M would be returned to the initial LPs in the fund, 17.2M would be returned to the DAO Membership, $9M would be returned as carry, and $5M would be used as Management Fees. From the $17.20M going back to the DAO Membership, in this example, we could say that $14.62M (85%) would be distributed to the membership tiers, and $2.58M would be set aside for patronage tokens. For the membership tiers, since each tier originally invested $1M into the DAO they each receive an equal 10% of the $14.62M or $1.46M each. This would then be divided up equally amongst the members of those tiers depending on how many of them there are. For the amount set aside for the patronage token owners. It would be the total amount of money set aside for token holders (2.58M in this example) divided by the total number of tokens held in member wallets. So if we assume there were 25k tokens in circulation each token holder would receive around $100 for each token they held. The exact price per token will be difficult to determine until we know number of tokens in circulation, returns of the fund, and total membership contributions. The process of determining what the price of each patronage token is will be determined when all of that information is available in an open and transparent manner with heavy involvement from the DAO Member Community. The carry of the fund (typically reserved for the full-time employees of VC funds), will be split between full-time employees of the DAO, Startup Grind Inc., and Startup Grind Chapter Directors.

Last updated